Bernanke Digs In To Defend US Stimulus Policy

Developments In The Conflict Over Currency Revaluation

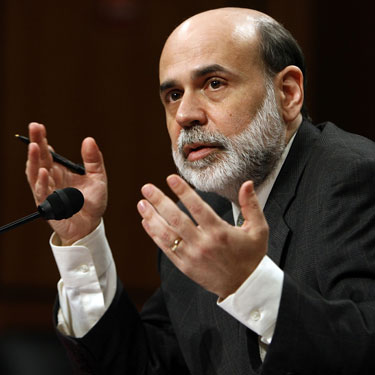

Courtesy of Topnews.in

The latest in the growing international trade deficit conflict between the US and emerging markets could have a large impact on US exports, therefore all American businesses that produce goods could see overseas demand grow. This would also have particular effects on major US shipping hubs like the port of Baltimore, Maryland.

President Barack Obama left the G20 meeting somewhat defeated after the barrage of criticism for American fiscal policy, but with some meager hopes that the language on international standards for currency valuation.

China (as the largest transgressor of artificially deflating it’s currency) is resisting all pushes to change their policy and the other global powers are still attacking the US for pushing money into their economy.

Enter the typically level-headed US Federal Reserve Chairman Ben Bernanke firing off at China with some of the strongest language the US has mustered publically, and throwing in a passionate defense for the Fed’s monetary stimulus measures. According to Bernanke, China’s weak-currency policy toward its currency (the Renminbi or Yuan)

Bernanke Delivers Fiery Rhetoric To European Bankers

Fed Chairman Bernanke is trying to defend the US central bank’s recent November 3rd decision to buy $600 billion in Treasury securities against critic that claim the move has weakened the dollar and resulting in a flow of capital into emerging markets (many of which make up the critics—like China & Brazil).

The move has also faced domestic criticism, largely from Republican congress members that claim it risks asset bubbles and fueling inflation.

The Fed chief’s response had a measure of strength that he has never managed to express publically. This seems to suggest that Bernanke is increasingly aware that he has been sucked into a whirl of international politics.

“Globally, both growth and trade are unbalanced,” Bernanke said. “Because a strong expansion in the emerging- market economies will ultimately depend on a recovery in the more advanced economies, this pattern of two-speed growth might very well be resolved in favor of slow growth for everyone if the recovery in the advanced economies falls short.”

China Fires Back

While Bernanke did not specifically mention China by name, the target of his attacks was clear. After Obama’s strong words spoken against China’s artificially low Yuan, the Fed chairman’s words that blamed the world economic woes on “large, systemically important countries with persistent current-account surpluses” had a clear target.

The message certainly wasn’t lost in Asia where China’s central bank responded to Bernanke with a shot over the bow of the US economy, saying it will raise the reserve ratio requirement for Chinese banks by fifty basis points staring November 29th. This led the dollar to fall from to $1.3671 par euro to $1.3643 per euro, which is (in international currency value terms) a sizable dive. The Standard & Poor’s 500 Index fell .2% to 1,194.17.

Competition & Exports

This international political posturing can have a major impact on the US economic recovery. Many economists see American exports and products being the key to quickening economic recovery. With the growth of internet-based sales, the higher cost of products is the only major hindrance to the US economy once again being a production-based country. With more equality on the global currency front, trade deficits will lessen and the US will see a much bigger share of international spending.